|

| Pam Danziger |

The U.S. jewelry market emerged from the recession to post a 7.5 percent increase in consumer expenditures from 2009 to 2010, after two successive years of negative growth. Yet the jewelry market today is very different than it was in 2006 and 2007 before the recession, according to a recently released report.

Unity Marketing's Jewelry Report 2011 notes that jewelry makers and retailers who are expecting to pick up where they left off with the same products targeting the same consumers will find themselves in the lurch.

“Since 2006 Unity Marketing has tracked dramatic changes in the jewelry market related to consumers' product and shopping preferences,” said Pam Danziger, president of Unity Marketing.

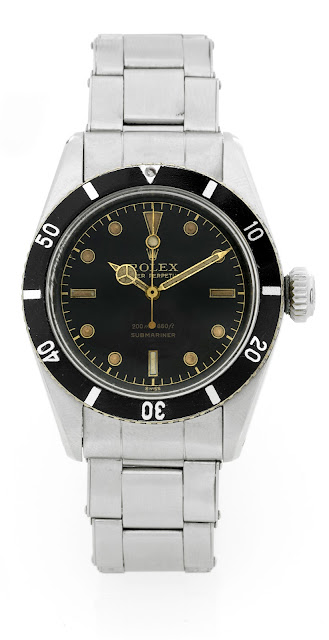

For one thing, increased demand for men's jewelry accounts for much of the market's growth.

“Among the most profound shifts our research uncovered is the growing demand for men's jewelry,” Danziger said. “While the rising cost of materials accounts for some of the growth, increased demand for men's jewelry also contributed to the rise in the jewelry market from 2008 to 2010.”

Jewelry marketers must innovate to find growth in the new economy, she added. “Jewelry marketers and retailers must take into account the many changes that their consumers have experienced coming out of the recession. Jewelry marketers have to be willing to challenge the old strategies and create new designs at new price points to be sold in new ways.”

An example of a company that took to innovation is Danish-based silver jewelry designer and manufacturer, Pandora. The company, known for its charm jewelry, posted worldwide growth of 92.6 percent to $1.2 billion in 2010.

Danziger explains each Pandora bracelet is a customizable piece that allows wearers to commemorate life events and interests with the addition of beads. With base bracelets in the $65 to $1,500 range and beads running from $40 to several hundred, this is a product that offers the opportunity for small splurges over time that will be meaningful to the owner.

“Rather than just selling another piece of jewelry, Pandora has transformed their product into an experience that its customers collect to commemorate milestone events and memories,” Danizger says. “Pandora is a game-changing competitor for traditional jewelry marketers. They sell a new type of jewelry item in new types of stores to a new value-conscious consumer eager to create a personal expression of their lives and memories. Pandora has a built in repeat business that has a loyal following, since nobody can buy just one Pandora charm.”

The example of Pandora also speaks of dramatic change that continue through 2011. The company's spectacular rise since it went public in October 2010 was followed by an equally spectacular fall in August, when its stock fell 70 percent in a day, following a less-than-stellar second quarter report where the company’s outlook was drastically downgraded. The company blamed rising prices for silver and other jewelry making materials and poor execution.

Unity Marketing's Jewelry Report 2011 notes that jewelry makers and retailers who are expecting to pick up where they left off with the same products targeting the same consumers will find themselves in the lurch.

“Since 2006 Unity Marketing has tracked dramatic changes in the jewelry market related to consumers' product and shopping preferences,” said Pam Danziger, president of Unity Marketing.

For one thing, increased demand for men's jewelry accounts for much of the market's growth.

“Among the most profound shifts our research uncovered is the growing demand for men's jewelry,” Danziger said. “While the rising cost of materials accounts for some of the growth, increased demand for men's jewelry also contributed to the rise in the jewelry market from 2008 to 2010.”

Jewelry marketers must innovate to find growth in the new economy, she added. “Jewelry marketers and retailers must take into account the many changes that their consumers have experienced coming out of the recession. Jewelry marketers have to be willing to challenge the old strategies and create new designs at new price points to be sold in new ways.”

An example of a company that took to innovation is Danish-based silver jewelry designer and manufacturer, Pandora. The company, known for its charm jewelry, posted worldwide growth of 92.6 percent to $1.2 billion in 2010.

Danziger explains each Pandora bracelet is a customizable piece that allows wearers to commemorate life events and interests with the addition of beads. With base bracelets in the $65 to $1,500 range and beads running from $40 to several hundred, this is a product that offers the opportunity for small splurges over time that will be meaningful to the owner.

“Rather than just selling another piece of jewelry, Pandora has transformed their product into an experience that its customers collect to commemorate milestone events and memories,” Danizger says. “Pandora is a game-changing competitor for traditional jewelry marketers. They sell a new type of jewelry item in new types of stores to a new value-conscious consumer eager to create a personal expression of their lives and memories. Pandora has a built in repeat business that has a loyal following, since nobody can buy just one Pandora charm.”

The example of Pandora also speaks of dramatic change that continue through 2011. The company's spectacular rise since it went public in October 2010 was followed by an equally spectacular fall in August, when its stock fell 70 percent in a day, following a less-than-stellar second quarter report where the company’s outlook was drastically downgraded. The company blamed rising prices for silver and other jewelry making materials and poor execution.

Despite the company’s recent woes, its charms and other jewelry remain popular throughout the world.